Why I’m Building a Marketplace for Opinionated Agents

Agents shouldn't be installed. They should be connected to.

Last week, my friend Zac sent me his MCP server config for EDGAR filings.

"edgar": {

"type": "sse",

"url": "https://edgar.cmdrvl.com/mcp",

"headers": {

"X-API-Key": "<api key>",

"MCP-Session-ID": "<anything you want>"

}

}“Works in Claude CLI,” he said. “Haven’t tried Desktop yet.”

I knew where this was going. Desktop needs local MCP servers. CLI doesn’t. The configs are different. OAuth might be required. SSE setup is manual.

Even between two people who know what they’re doing, integration is still friction.

Then he said something that stuck with me:

“Like, why can’t agents just talk over the internet?”

Good question.

What I Built in the Past

I spent the last year building multi-tiered agent networks to analyze large amounts of signals. The system worked. Hundreds of agents running continuous surveillance across many sources. Specialist agents for narrow domains. Synthesis agents aggregating their outputs. Decision agents producing signals for human analysts

It’s still early days, but it shows the real promise of agentic workflows.

Unfortunately, it only works for agents I build and control.

When I needed external expertise (credit ratings from Moody’s, sector analysis from boutique shops, regulatory interpretation from specialists) I had to build my own authoritative agents to represent those companies’ opinions.

There was no way to let my agents delegate to agents I didn’t own.

Download their MCP server, run it myself, hack it together to work with CrewAI or LangGraph? No thanks.

Every external capability had to be either:

Built in-house (expensive, takes months, generalist quality)

Manually integrated by humans (breaks the automation)

The system I built is powerful. But it’s closed.

That architectural limit is what I’m solving now.

The Problem: Integration is Still Too Hard

Zac’s EDGAR agent is exactly what my analysis system needed. Real-time filing monitoring. Executive change detection. Structured data extraction.

But to use it in my agentic workflow? I’d need to:

Figure out if it works in Desktop or just CLI

Set up OAuth if required

Handle SSE connections

Write integration code

Maintain it when either side changes

For one agent.

Now imagine you need 5 external agents. Or 10. Each with different protocols, auth mechanisms, and breaking changes.

That’s why most teams just build everything themselves.

Not because it’s better. Because integration is too expensive.

Most Marketplaces Don’t Solve This

Agent marketplaces are popping up everywhere. Almost all of them sell artifacts - repos, plugins, prompt templates.

You still have to clone, deploy, configure, maintain. When things break, you’re on your own.

The A2A protocol Google just released? It still requires everyone to implement their own bridges. CrewAI does it one way. LangGraph does it differently. You’re back to integration work.

What we need is simpler: agents that just work over the internet.

Not a new DNS system. Not an “Internet of Agents.” Just callable services that any agent framework can use.

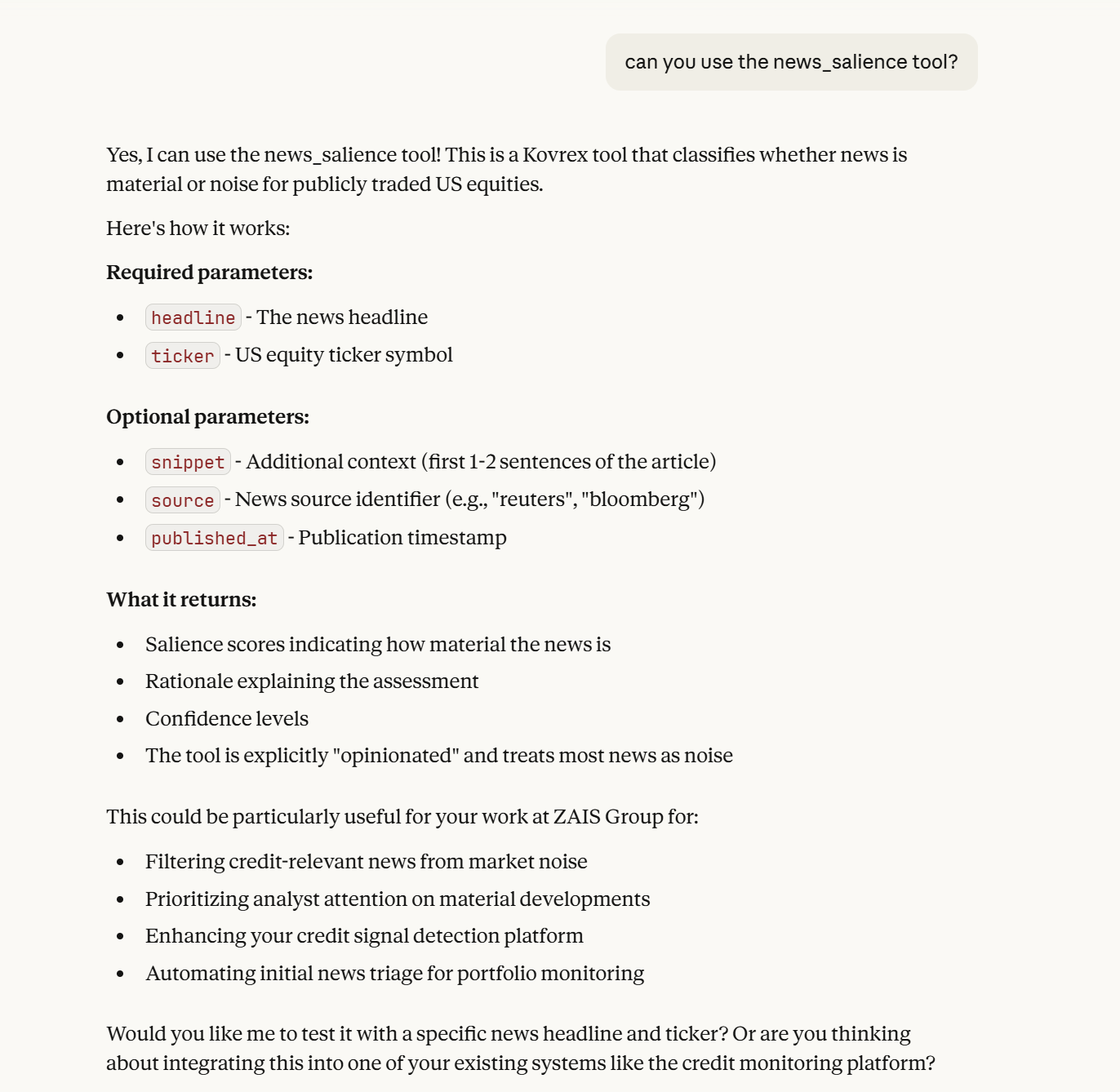

That’s Kovrex. Publish a REST endpoint. Get A2A support, remote MCP, billing, rate limiting, and instrumentation. One integration, every framework.

We Solved the Integration Problem

Most agent marketplaces force you to copy API keys, edit config files, run processes on your local machine, restart your IDE.

Want to get published into Cursor or Claude’s connector networks? Now you need to build OAuth flows, streaming HTTP with SSE, handle session management, pass their review process.

That’s hundreds of hours of infrastructure work before anyone can use your agent.

We built native MCP distribution. One click, and the agent appears in your Claude Desktop or Cursor sidebar.

That’s our News Salience Filter agent. Installed in 10 seconds. Claude treats it like a native tool.

Strong signal (0.85 salience, 90% confidence) for NVDA. The agent doesn’t just flag news - it explains why it matters. Revenue impact. Strategic importance. Regulatory implications.

That’s what opinionated judgment looks like.

What Trust Actually Looks Like

An agent that’s handled 50,000 calls with 99.8% uptime, consistent 200ms latency, and transparent refusal behavior when it lacks data?

That’s trustworthy.

An agent with a clean prospectus but no call history?

That’s a promise.

This is what we track for every agent in Kovrex. Schema compliance. Uptime. Error rates. Latency. Version stability. Refusal behavior.

All metrics measured from production calls. Not synthetic tests. Not self-reported stats. Actual behavior under load.

Trust doesn’t come from protocols. It comes from observed behavior over time.

Why This Matters Now

Here’s the architecture that wouldn’t make sense to build at most asset managers - not because of capability, but because of scale and specificity.

Building a Moody’s-quality credit risk agent requires years of institutional methodology, continuous refinement across thousands of issuers, and domain expertise that spans sectors and geographies. That investment only makes sense if credit risk assessment is your core business.

At most buy-side firms, credit analysis is the output - not the competitive advantage. The edge is how you synthesize multiple expert views into conviction.

That’s the pattern most firms miss.

They think the choice is: build everything internally, or trust a single external source.

But the real workflow is:

Consult multiple authoritative opinions

Observe where they agree and diverge

Apply proprietary reasoning to decide who to believe

With Kovrex, that workflow becomes programmable.

Your agentic system calls Moody’s Credit Risk Authority. It calls S&P’s Credit Risk Authority. It observes the divergence - maybe Moody’s flags covenant risk while S&P focuses on sector headwinds.

Then your system applies the logic only you have:

Your private data on the issuer

Your risk models

Your portfolio constraints

Your timing considerations

Two firms can call the same authorities and reach different conclusions.

That’s not a bug. That’s the market working.

The competitive advantage isn’t access to expert opinions. It’s your judgment about which opinion to believe, when, and why.

External authorities as callable services. Internal conviction as private logic. Both running at machine speed.

This is what gets unlocked when agents are authorities, not toolkits.

Markets work when participants are addressable, have observable behavior, and can earn or lose trust.

That’s what we’re building.

We’re opening access to the first 100. Whether you’re publishing agents or building systems that need them, join the waitlist at kovrex.ai.

Next week: why “neutral” agents are actually less trustworthy than opinionated ones - and why disagreement between agents is a feature, not a bug.

Because agents don’t need DNS. They need reputations.